[$3,600] Advance Child Tax Credit 2024, Income Limit, When Will It Start : Check Date of Release. Monthly Report Status of Advance Child Tax.

[$3,600] Advance Child Tax Credit 2024, Income Limit, When Will It Start

Starting July 15, millions of American families will automatically begin receiving monthly Child Tax Credit payments from Treasury Department and Internal Revenue Service. These payments are going to cover half of credit for which families will likely qualify to receive when they file their 2024 federal income tax return.

If applicants qualify and previously filed tax return, they don’t need to do anything. Payments will begin arriving automatically. The registration dates for the Advance Child Tax Credit 2024 have not been officially announced yet. The payments for Advance Child Tax Credit 2024 are set to begin on July 15, 2024. The Advance Child Tax Credit for 2024 will provide up to $3,600 annually for each child under age of six, with monthly payments of $300. For children aged 6 to 17, annual amount is $3,000, with monthly payments of $250. The eligibility is based on modified adjusted gross income (MAGI) and age of children.

Highlights

| Name | Advance Child Tax Credit 2024 |

| Body | Treasury Department and Internal Revenue Service |

| Mode of Application | Online |

| Payment Start Date | 15th July, 2024 |

| Payment Amounts for Advance Child Tax Credit 2024 | 1. Children under 6 years old: Up to $3,600 annually ($300 per month)

2. Children aged 6 to 17: Up to $3,000 annually ($250 per month) |

| Income Limits for Advance Child Tax Credit 2024 | 1. Single filers: Up to $200,000

2. Joint filers: Up to $400,000 |

| Eligibility Criteria of Advance Child Tax Credit 2024 | Based on modified adjusted gross income (MAGI) and age of children |

| Last date to Apply for Advance Child Tax Credit 2024 | Announces soon |

| Contact | 800-908-4184 |

| Official Website | www.irs.gov |

About Child Tax Credit

The current child tax credit is a non-refundable tax credit available to taxpayers with dependent children under age of 17. The credit can reduce your tax bill on a dollar-for-dollar basis. Some taxpayers may receive a partial refund of credit through what’s called “additional child tax credit.” Taxpayers must also meet certain income rules because credit phases out for high earners. Once modified adjusted gross income (MAGI) exceeds limit for filing status, credit amount that they get may be smaller, or may be deemed ineligible.

- For 2024 (taxes filed in 2025), child tax credit will be worth $2,000 per qualifying dependent child if MAGI is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

- If MAGI exceed above limits, credit is reduced by $50 for each $1,000 of income above threshold until it phases out completely.

- The refundable portion, also known as additional child tax credit, will be worth up to $1,700 — up from $1,600 in 2023.

Eligibility Criteria for Advance Child Tax Credit 2024

- Citizenship/ Nativity: Per IRS, child who is only a “U.S. citizen, U.S. national or U.S. resident alien,” are eligible to apply for Advance Child Tax Credit 2024. They must hold a valid Social Security number. The child that applicants are claiming for need to first live with them for at least half a year (there are some exceptions to this rule).

- Age: Child is not older than the age of 17 at end of tax year.

- Income: Parents or caregivers claiming credit also typically can’t exceed certain income requirements. Depending on how much income exceeds that threshold, credit gets incrementally reduced until it is eliminated.

- Dependent status: You must be able to properly claim child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid. The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

- Income: Parents or caregivers claiming credit also typically can’t exceed certain income requirements. Depending on how much income exceeds that threshold, the credit gets incrementally reduced until it is eliminated. Applicant must have provided at least half of child’s support during last year. In other words, if qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Important Documents for Advance Child Tax Credit 2024

- Proof of Identity:

- Social Security numbers (SSNs) for each child

- Your own SSN or Individual Taxpayer Identification Number (ITIN)

- Proof of Income:

- Recent tax returns (Form 1040)

- W-2 forms from employers

- 1099 forms for other income

- Proof of Residency:

- Utility bills, lease agreements, or mortgage statements showing your address

- Proof of Relationship:

- Birth certificates or adoption papers for each child

- Bank Information:

- Bank account details for direct deposit

- Forms to Complete

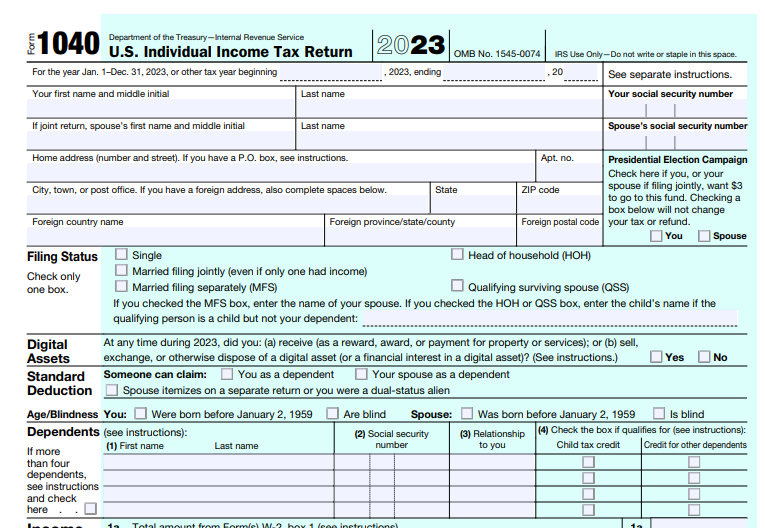

- Form 1040: U.S. Individual Income Tax Return

- Schedule 8812: Credits for Qualifying Children and Other Dependents

Important Dates of Advance Child Tax Credit 2024

| Event | Dates |

| Application Start Date of Advance Child Tax Credit 2024 | Ongoing |

| Advance Child Tax Credit 2024 Payment Start Date | 15th July, 2024 |

| Last Date to Apply for Advance Child Tax Credit 2024 | announces soon |

How to Apply for Advance Child Tax Credit 2024?

- First, applicants need to verify and determine their eligibility, i.e., income limits, child’s age, valid social security number.

- For next step, applicant needs to gather required documents, i.e., Proof of Identity, proof of income, proof of residency, proof of relationship, bank information.

- Applicants must also complete required forms,

- Form 1040: U.S. Individual Income Tax Return.

- Schedule 8812: Credits for Qualifying Children and Other Dependents

- Completed forms and documents can be submitted online, through IRS website. Applicants can also send their forms to IRS address provided on form instructions.

- Then applicants can track their application status through IRS online tools.

click here to go to official IRS website to download forms for Advance Child Tax Credit 2024 application.

Click here to visit official white house website to know more about the policy

- [$3,600] Advance Child Tax Credit 2024, Income Limit, When Will It Start

- Highlights

- About Child Tax Credit

- Eligibility Criteria for Advance Child Tax Credit 2024

- Important Documents for Advance Child Tax Credit 2024

- Important Dates of Advance Child Tax Credit 2024

- How to Apply for Advance Child Tax Credit 2024?

Hello I am jobless please give me any job