Cersai KYC Registration 2024-CKyc Update Identifier Meaning (Means),What is Cersai in Banking, Kyc Identifier process

Cersai Registration 2024 – Cersai Kyc Update Identifier

Registrations for the CKYC are ongoing on the official website of Cersai. Customers who have borrowed any loan or want to borrow in future can easily get themself registered and get a universal KYC that can be used in all the banks and fund houses. Its a relatively new and innovative move to collectively hold the information relating to security interest of immovable, movable, intangible properties and assignment of receivables at one place i.e Central KYC Record Registry and therefore unifies the entire financial system of country.

Cersai Kyc Meaning ?

KYC means Know Your Customer. A CKYC means Central KYC which is a collective system to keep the KYC data of customers with the government at CERSAI. Main process involves customers to go to their Banks, Mutual Funds and Insurance institutions a.k.a REs. Then these Registered Entities (RE) will be going on the official site of the Cersai and provide all the necessary details like Adhaar, PAN card, Security Interest Details, Asset details, Assessee details, Asset owner and holder details and then simply waiting for 10 days to get an all in one 14 digit unique KYC identifier number. This number can be used in all financial institutions by the customers for all the types of transactions.

| CERSAI full form | Central Registry of Securitization Asset Reconstruction and Security Interest of India |

| Managed by | Finance Ministry, National housing bank and 10 public sector banks |

| Contact email | Helpdesk.cersai.org.in |

| Official website | www.cersai.org.in/CERSAI/home.prg |

| Central KYC Records Registry portal | www.ckycindia.in/ckyc/index.php |

About Cersai :

The Central Registry of Securitisation Asset Reconstruction and Security Interest of India was established in 2011 under the provision of SARFAESI Act 2002 (Securitization And Reconstruction of Financial Assets and Enforcement of Security Interest ). It’s a public company registered under section 8 of companies act 2013. The company got incorporated to work as an online security interest registry for main 4 corporations (SEBI, RBI,IRDAI and PFRDA). This would enable these authorities to keep a check on the lending activities around the country and prevent any fraudulent activities.

Benefits of CKYC Identifier Registeration with Cersai

- Single all-in-one KYC for all financial activities.

- No need to re-register with new banks, fund houses.

- Easy access and information availability about various assets.

- Reduction in KYC cost of customers and institutions

- Improved security of customers data

- General public can search (asset based/borrower based) the data on site upon payment of a nominal fee.

Documents for cersai registration:

- Aadhaar card

- PAN Card

- Passport size photograph

- Bank account details

- Other necessary documents specified by the RE(registered Entity)

Process of CKYC Identifier registeration with Cersai

- Go to a Registered Entity (RE) with CERSAI (your bank, Mutual fund, Insurance institution etc)

- Submit the required documents

- The Registered Entity will submit the documents themselves on CKYCR. The request for your CKYC will initiated automatically.

- Within 10 to 15 days you will receive your 14 digit unique CKYC number.

- Final step is to complete the Biometric authentication process

- In case, the customer needs to update their KYC they can approach their financial institution. Upon submitting the required documents. The institution will get an update about the same from CKYCR.

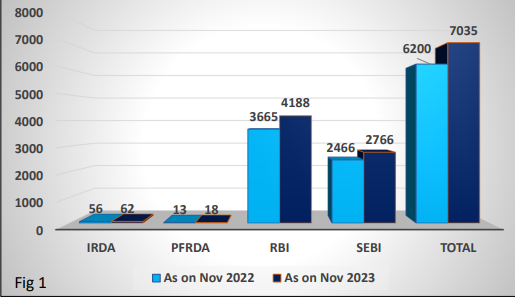

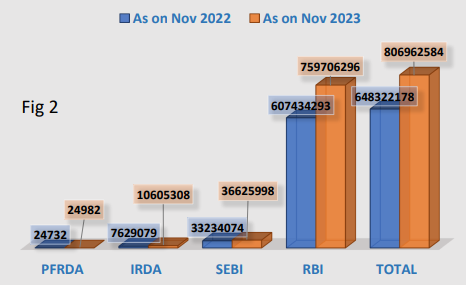

Growth of Cersai KYC registration so far

Click Here to do your RE Cersai KYC Registeration

CKYC is a KYC registration of loan borrowers with CERSAI to keep a centralised repository of information. This creates an ID of customers with their RE so then they do not need to do KYC every time they take any financial service. Customers get a CKYC ID which is a unique 14 digit number valid for a lifetime.

Central KYC repository is only accessable by authorised institutions or other notified institutions under the Prevention of Money Laundering Act or rules framed by the Government of India or any Regulator (RBI, SEBI, IRDA, and PFRDA) there under

All customers of financial institutions like Banks, Insurance Companies, Mutual fund companies etc also known as RE(Registered Entities) need to get their CKYC done through their respective service providers.

Registered Entity (RE) is an institution which provides financial services like banking, insurance, investment etc and is registered with regulatory authorities (RBI, SEBI, IRDAI) to provide their customers with CKYC. Eligible entities to become an RE are Banks, Insurance companies, mutual funds, securities market intermediaries (like brokers), and non-banking financial companies (NBFCs).

An individual can check their CKYC number by first Loging on to the website of the financial services company that offers CKYC checks, then enter their PAN card number. Next, enter the security code that’s shown on the screen. The CKYC number will show on the screen.

- Cersai Registration 2024 – Cersai Kyc Update Identifier

- Cersai Kyc Meaning ?

- About Cersai :

- Benefits of CKYC Identifier Registeration with Cersai

- Documents for cersai registration:

- Process of CKYC Identifier registeration with Cersai

- Growth of Cersai KYC registration so far

- Click Here to do your RE Cersai KYC Registeration

School Is The Temple

Teacher Is God

Registeion

mahacmlettr

माझी शाळा सुंदर शाळ

11th

School is the temple

and teachers is the god