gst.gov.in Login – Gst Challan online Payment, invalid Cpin in Gst Payment. What is Gst Pmt 06 Payment Check Online on www.gst.gov.in. finance ministry release notification for Gst Pmt 06 Payment due in this month.

GST Challan online Payment 2024

Summary

- Generate online challan for the upcoming GST payment

- Some problems like payment failure, status of challan faced during filling of challans are mention in detail with solutions.

- GST pmt 06 is due by April 13 2024. More information about GST Pmt 06 is mention in detail.

The Finance Ministry introduced the Quarterly Return Monthly Payment (QRMP) scheme to make GST compliance easier for small taxpayers. This scheme allows taxpayers to file their GST returns quarterly rather than monthly and make monthly payments. Form GST PMT -06 is a payment order used to pay taxes, interest, fines, fees, or other amounts owed under the Goods and Services Tax. This payment order is used to deposit the amount payable by the taxpayer into their electronic cash book or electronic credit book on the GST portal..

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax system implemented in India. It has transformed the indirect tax structure by amalgamating several central and state taxes into a single tax system. To facilitate the payment of this tax, the government has introduced the GST Challan. This article aims to provide a comprehensive guide on how to make a GST Challan online payment.

What is a GST Challan?

A GST Challan is a document that is used for depositing or remitting the payment of taxes to the government. It serves as proof of tax payment. The Challan can generated online on the GST Portal and is identified by a 14-digit Common Portal Identification Number (CPIN).

The GST Challan online payment system has simplified the process of paying taxes. It is user-friendly and can done from the comfort of the home or office. Timely payment of GST is not only a legal obligation but also a responsibility towards nation-building.

What is the form GST PMT -06?

Form GST PMT -06 is a payment order used to pay taxes, interest, fines, fees, or other amounts payable under the Goods and Services Tax (GST). This payment order is used to deposit the amount payable by the taxpayer into their electronic cash book or electronic credit book in the GST portal. Form GST PMT -06 can created online on the GST portal and can use it to make payments through various methods, including internet banking, debit card, credit card, NEFT, RTGS, or counter payment at a bank. The payment request includes information on the taxpayer, the amount to paid, the type of tax, and the period for which the payment will made, among other information. Upon successful payment, a Challan Identification Number (CIN) is generated, which can used to track the payment status.

Highlights

| Name | GST Challan Online portal/payment |

| Name of the order | GST PMT 06 |

| Body of the portal/payment | Goods and Services Tax Network (GSTN) |

| Go through Eligibility | any individual who has GST liability |

| GSTR 06 due date | 13 April 2024 |

| Mode of GST Challan Payment | Online |

| Mode of GST PMT 06 | Online |

| GST Official Portal | Gst.gov.in |

| Contact | Help Desk Number: 0120-4888999

Email : [email protected] |

GST Challan important points and descriptions

| Important Points | Description |

| GST Portal Login | The process begins by logging into the official GST Portal. |

| Navigation to Payments | From the dashboard, navigate to ‘Services’, then ‘Payments’, and finally ‘Create Challan’. |

| Payment Details Entry | Enter the details of the payment, such as the amount of IGST, CGST, SGST, and Cess, if applicable. |

| Payment Method Selection | Select the payment method (E-Payment, Over the Counter, or NEFT/RTGS) and generate the challan. |

| Payment Completion | You will redirected to a payment gateway to complete the payment. |

| Confirmation and Receipt | After successful payment, a Challan Identification Number (CIN) is generated. You can download the receipt. |

| CPIN Validity | The CPIN is valid for 15 days from the date of its generation. |

| Troubleshooting | If issues arise, such as amount deducted but not reflected in Cash Ledger, or NEFT/RTGS related issues, grievances can raised on the GST Portal. |

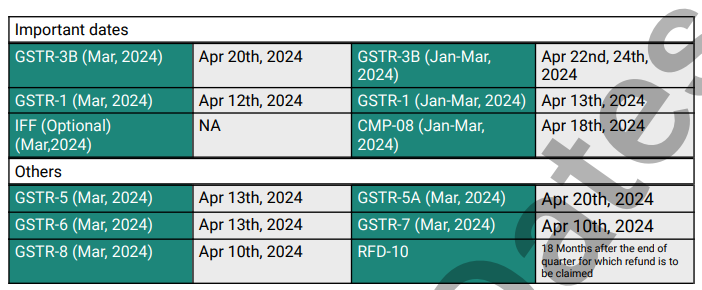

Important dates of upcoming GSTR 2024

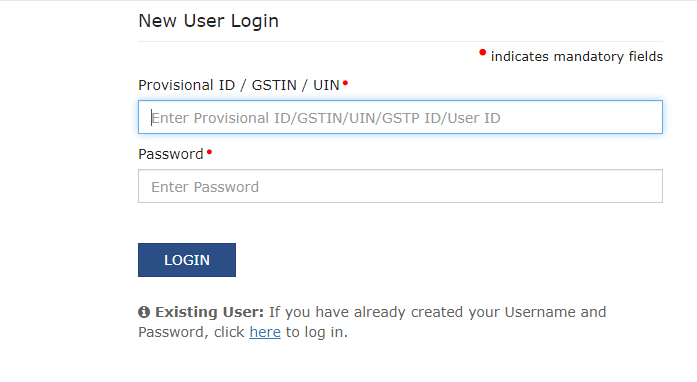

How to Login to GST Challan portal?

- Access the GST portal at the official website, gst.gov.in.

- Click on the Login button.

- Enter your username and password.

- Click on the Services tab.

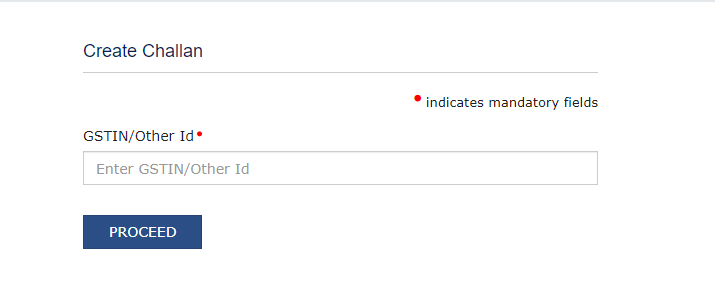

- Navigate to Payments > Create Challan.

- Enter your GSTIN or other applicable ID, enter the captcha code, and click on Proceed.

Steps to track GST payment status online before logging

- Go to the GST portal.

- To track payment you don’t have to login. On the Dashboard, go to the Services tab>Payments>Track Payment Status. Enter in your GSTIN and the CPIN. Upon entering these two details, you will asked to enter the captcha code and proceed. Click Track Status.

- The payment status is shown as Paid or Not Paid.

- The status of the challan gets displayed for your further action.

Case 1: If status is displayed as ‘PAID’

In this case, the ‘View receipt’ button gets enabled, as shown below.

The taxpayer can view and download the receipt, after clicking on the ‘View receipt’ button.

You may click on the ‘Download’ button to download the receipt.

Case 2: If status is displayed as ‘NOT PAID’

You can save an offline copy by clicking on the ‘Download’ button.

If you want to view the challan click ‘View Challan’. The challan will open as below. You can save an offline copy by clicking ‘Download’.

Steps to track GST payment status online after logging

- Login to the GST portal.

- Click on the ‘Services’ tab > ‘Payments’ section > ‘Challan History’

- Search by CPIN or by date. List of challans and payment status displayed.

Steps to follow in case of CPIN failure or other failures

a) Difference between CPIN & CIN. Which is which?

- CPIN stands for Common Portal Identification Number whereas CIN stands for Challan Identification Number. The 14-digit CPIN number generated before payment of GST and the 17-digit CIN number issued after payment of GST.

- The CPIN issued at the time generating GST tax challan online. An online GST tax challan can saved temporarily and edited before generating the final challan.

- After cross-checking, you can submit the challan. On submission, GST Portal generates a challan with a 17-digit unique identity number. This number is CIN. Every CIN is a 17-digit unique code.

- It comprised the 14-digit CPIN along with a 3-digit Bank Code.

b) Account got debit more than once for the same online transaction. How to reverse the transaction?

Situation 1: If both transactions reflected in the Electronic Cash Ledger, then you must contact the Help Desk using the contact numbers/e-mail IDs given on the GST Portal.

2nd Situation : If the Electronic Cash Ledger has only one transaction amount, then it may a transaction error. You should contact your bank.

Situation 3: If funds debited but the CIN is not generated or the CIN generated but not communicated, then you can use GST PMT-07 to apply to the bank or electronic gateway through the common portal.

This is available on the GST portal. On the GST Portal go to Services>User Services>Grievance/ Complaints. Under ‘Submit Grievance’ select the ‘Grievance Type’. Fill up all the details and submit.

c) Made an offline payment (cash/cheque/DD) after the challan expiry date and the bank has accepted it. However, it is showing as ‘Not Paid’ on the GST Portal. What to do?

A GST challan is valid for 15 days and gets cancelled automatically after the validity period. The taxpayer has 2 options-

- Pay GST tax with the challan (with CPIN) within validity period or

- Request for a fresh GST challan online after entering the necessary data

If the payment is made after the expiry date, its not possible to update it on the Portal. So, even if the bank accepts the payment, GST Portal can reject it due to this reason. Therefore, approach the bank and seek a refund for the same. Meanwhile, generate a new challan on the portal.

d) Paying via a cheque. Where can to fill up the challan?

For all modes of payment, the challans must generate through online modes only. For Over-the-Counter payments (cheque/cash/DD) the citizen must print out of the challan and use the same. Remember, not to fill the challan manually. Only online challans are acceptable.

e) For the same online transaction, account got debit more than once. How to reverse debit.

If the total of both transactions appears in the Electronic Cash Ledger, please contact the help desk via the GST portal’s contact numbers/email addresses. If the Electronic Cash Ledger only shows the original transaction number, please contact the bank because it may a transaction mistake.

Taxpayers may use the Application (GST PMT 07) for Credit of Missing Payment under the Grievance Section of the GST Portal. Only in case if a CIN not created but money got deducted or if a CIN generated but not recorded.

More about Form GST PMT -06

Form GST PMT -06 is a payment challan for taxpayers to make payments for various types of levies under the GST, such as taxes, interest, penalties, fees, or other amounts payable. One can only create the payment request online and also submit it online through the GST portal.

Tax payers can make payment in various ways, such as internet banking, debit card, credit card, NEFT, RTGS, or counter payment in a bank. The taxpayer must select the appropriate tax header for which the payment is to made and enter the appropriate information in the payment request.

Overall, the GST PMT -06 form is an essential component of the GST system, enabling taxpayers to pay their taxes on time and correctly.

The form contains the following information:

- Name and address of the taxpayer

- GSTIN of the taxpayer

- Date of payment

- Type of payment

- GSTIN/temporary ID of the taxpayer, in case of a new registration

- Details of the amount to paid, such as tax header and period

- Challan identification number (CIN) generated after successful payment

When to make GST PMT -06 payment?

The due date for payment using form GST PMT -06 depends on the type of tax liability and the frequency with which the taxpayer files tax returns.

For taxpayers who must file monthly returns, the due date for payment using form GST PMT -06 is the 20th of the following month or earlier. Those taxpayers who already mention by the Quarterly Return Filing System (QRMP). the due date for payment using Form GST PMT -06 is the 25th of the month following the end of the quarter.

Its important to note that the payment must made before the tax return filed. Failure to make the payment on time may result in interest, penalties and other consequences under the GST law.

Methods of GST PMT -06 payment under the QRMP scheme

The Indian government introduced the Quarterly Return Monthly Payment (QRMP) scheme to simplify GST compliance for small taxpayers. Under this scheme, taxpayers can file their GST returns quarterly instead of monthly and make monthly payments.

Taxpayers have two options when making payments under the QRMP scheme:

- Fixed amount method: Under this method, taxpayers can pay a fixed amount on their GST liability for the first two months of the quarter. The amount paid should equal the amount paid in the previous quarter for the same period. For example, if the taxpayer paid 10,000 rupees as GST liability for January and February of the previous quarter, they can pay 10,000 rupees for the same months of the current quarter. In the third month of the quarter, taxpayers may adjust their payment based on their actual GST liability.

- Self-Assessment Method: Under this method, taxpayers can calculate their monthly GST liability based on their monthly sales and purchases and make payments accordingly. Using their GSTIN (Goods and Services Tax Identification Number), taxpayers can create a payment request through the GST portal to make the payment.

Taxpayers can switch between the two methods every quarter depending on their business needs. In addition, taxpayers required to submit their GST returns quarterly under the QRMP system.

How to use the form GST PMT -06?

Form GST PMT -06 is a payment form that taxpayers who have opted for the QRMP scheme can use to make monthly payments for their GST liability. Here are the steps to use form GST PMT -06:

- Log in to the GST Portal (gst.gov.in) with your GSTIN and password.

- Navigate to the ‘Services’ section and select the ‘Payments’ option.

- Click the ‘Create Challan’ button and select ‘Form GST PMT -06’ from the drop-down menu.

- Enter the relevant details such as taxpayer name, GSTIN, payment period (month and year), and payment amount.

- Select the payment method – i.e. either the fixed amount or the self-assessment method – and enter the appropriate payment amount.

- Verify the information entered in the form and click the ‘Generate Challan’ button.

- The system will generate a GST PMT -06 challan that user can download and save for later.

- Make the payment using any available payment methods such as net banking, debit/credit card, NEFT/RTGS, etc.

- After successful payment, the system will generate a receipt you can download and save for future reference.

It is important to note that taxpayers must make payment within the due date for the payment period. Late payment of GST debt may result in interest and penalties.

click here to go to official website of GST, create your challan for GST pmt 06 2024

- GST Challan online Payment 2024

- Summary

- What is a GST Challan?

- What is the form GST PMT -06?

- Highlights

- GST Challan important points and descriptions

- Important dates of upcoming GSTR 2024

- How to Login to GST Challan portal?

- Steps to track GST payment status online before logging

- Case 1: If status is displayed as ‘PAID’

- Case 2: If status is displayed as ‘NOT PAID’

- Steps to track GST payment status online after logging

- Steps to follow in case of CPIN failure or other failures

- b) Account got debit more than once for the same online transaction. How to reverse the transaction?

- c) Made an offline payment (cash/cheque/DD) after the challan expiry date and the bank has accepted it. However, it is showing as ‘Not Paid’ on the GST Portal. What to do?

- d) Paying via a cheque. Where can to fill up the challan?

- e) For the same online transaction, account got debit more than once. How to reverse debit.

- More about Form GST PMT -06

- When to make GST PMT -06 payment?

- Methods of GST PMT -06 payment under the QRMP scheme

- Taxpayers have two options when making payments under the QRMP scheme:

- How to use the form GST PMT -06?