Official portal : pmfme.mofpi.gov.in Pmfme loan Govt Scheme Apply (Online Application), Subsidy

PMFME loan Govt Scheme Apply

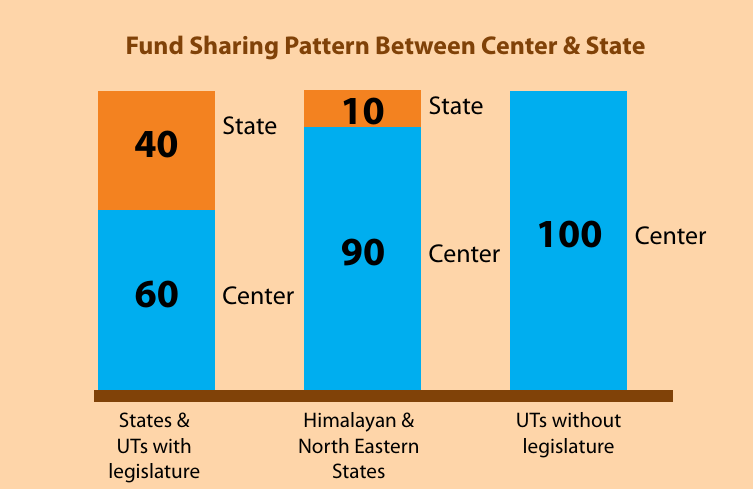

Ministry of Food Processing Industries introduce PMFME scheme to empower its unorganised food processing sector. There are around 25lakh micro enterprises which generates 75% employment in this sector but contributes much less to the overall GDP. These enterprises face many challenges like access to modern technology & equipment, training, access to institutional credit, lack of basic awareness on quality control of products, and lack of branding & marketing skills, etc. Therefore, with the purpose of overcoming these challenges making these enterprises stronger the MoFPI is launching Prime Minister Formalisation of Micro Food Processing Enterprises Scheme (PM FME). It is to support various elements of MSME Food processing industry like Farmer Producer Organisation (FPOs), SHGs, Producers Cooperatives and Cooperative Societies and other small businesses.

Government will undertake activities like easy loans, subsidised raw material, capacity building, skill training, seed capital, Branding and Marketing Support etc. Candidates who are above 18 years of age and own any MSME firm, member of related SHG or has any related idea can apply for PM FME scheme through their official website. Applicants of Loan or Subsidy can submit PMFME Online application on official website by following below mention steps.

Highlights

| Name | PM Formalisation of Micro Food Processing Enterprises Scheme (PM FME) |

| Body | Ministry of Food Processing Industries |

| Aim | Atmanirbhar Bharat, Vocal for Local |

| For | MSME in food processing business |

| Eligible | Enterprises whose annual turnover is not more than 5 cores. |

| Benefits of PM FME scheme | Credit link subsidy, ODOP, Common Infrastructure, Seed Capital for SHGs, Capacity Building, Marketing & Branding. |

| Mode of application | Online |

| Contact | 9254997101,9254997102 |

| Official website | pmfme.mofpi.gov.in |

About PM FME

PM Formalisation of Micro Food Processing Enterprises Scheme (PM FME) is a central scheme of Food Processing Industries ministry to support and empower the Micro Food Processing Industries of India. This industry employs majority of population but their contribution in the national economy remains low due to various challenges faced by them due to being an unorganised sector. The scheme will provide easy credit access with longer payback duration and low interests to these MSMEs. There are subsidies, seed capital, skill training programmes and marketing support etc for the beneficiaries. It allows beneficiaries to borrow loans even if they are already a beneficiary of any other government scheme. PM FME scheme has an outlay of Rs 10,000 crores for coverage of around 2 lakh enterprises from 2020-2024.

Elements of PM FME scheme

| Element | Features |

| One-District-One-Product | Focus on producing one prime product in the entire district to ensure everyone benefits from economy of Scale, availing necessary common services, easy procurement etc. The product is called ODOP which will become a speciality of that particular area. It can extend beyond a district and can be a perishable agri-produce, cereal base product etc. Example- products includes mango, potato, litchi, tomato, kinnu, bhujia, petha, papad, pickle, millet based products, fisheries, poultry, meat |

| Support to Processing Units | 1. Credit linked grant at 35% of project upto Rs 10 Lakh

2. Seed capital to SHGs of Rs 40,000 per member in the industry. 3. Support of marketing and Branding upto 50% of expenditure. 4. Infrastructure upgradation covering a fraction of their cost. |

| Upgradation of Food Processing Units | 1. For individuals: credit-linked capital subsidy @35% of the eligible project cost for expansion/ technology upgradation with a maximum ceiling of Rs.10 lakh per unit.

2. For group: Grant capital subsidy of 35% with credit linkage for capital investment to FPOs/SHGs/ Producer cooperatives etc. |

| Creation of Common Infrastructure | Building a common production facility, incubation centre, warehouses for multiple units to use. |

| Branding and Marketing Support | Branding and marketing support to ensure standardization, quality control, common packaging for the products of units.

Bring as many units together that are engages in same business as possible. Support up to Rs.5 lakh is available from State Nodal Agency for preparing DPR for proposals for branding & marketing. |

| Capacity Building and Research | Training to parties on all levels of value chain like RPs, Enterprises/SHGs and the Trainers themselves for formalization of Micro Food Processing Enterprises. |

General Eligibility Criteria for PM FME scheme

- MSME enterprises whose turnover is not more than Rs 5 core per annum. Initial capital of the business is not more than 1 crore.

- Individuals who are above 18 years of age are eligible to apply for PM-FME scheme.

- Ownership/rental/leasehold right of the enterprise must belong to the applicant

- Only one person from a family is eligible to apply for PM FME scheme

1. One-District-One-Product (ODOP)

| Meaning | Bring one speciality product from one District/Cluster. Provide infrastructural support to those who are engaged in production of common product. |

| Eligibility for ODOP | All FPOs, SHGs, FCPs and individual units that are in MSME food processing business.

However preference given to those who are engaged in production of that one ODOP product. |

| Benefits under ODOP-FME scheme | 1. Credit-linked capital subsidy @35% of the eligible project cost, maximum ceiling Rs.10 lakhs per unit

Beneficiary contribution – minimum of 10% of the project cost, balance loan from Bank. 2.Credit linked Grant @35% to support clusters and groups such as FPOs/ SHGs/ Producer Cooperatives along their entire value chain. Seed capital @ Rs. 40,000/- per member of SHG involved in food processing activity for working capital and purchase of small tools. 3. Support to individual SHG member as a single unit of food processing industry with credit linked grant @35% of the project cost, maximum ceiling Rs.10 lakh. 4. Common infrastructure support by making common necessities like raw material, warehouse, marketing/standardization etc available to all units. 5. Branding Support upto 50% of the cost of enterprises. |

2. Support to processing units

| Meaning | Providing all types of support from finance, to skills, to upgradation, subsidies etc to units engaged in the sector. |

| Eligibility for PM FME-Processing Units support | 1. Individual / Partnership Firm with ownership right of the enterprise;

2. Existing micro food processing units in the survey or verified by the Resource Person; 3.The applicant should be above 18 years of age and should possess at least 8th standard pass educational qualification; 4. Only one person from one family (self+spouse+children) is eligible for obtaining financial assistance.

|

| Benefits | Credit linked grant at 35% of the project cost with maximum grant up to Rs 10.0 lakh to existing unorganised food processing units for both individual enterprises and SHGs.

|

3. Upgradation of Food Processing Units

| Meaning | This is to upgrade and already running business in terms of technology, infrastructure and other areas. |

| Eligibility for Group applicants | 1. It should be engaged in processing of ODOP produce for at least three years;

2. In case of FPOs / cooperatives, they should have minimum turnover of Rs.1 crore and the cost of the project proposed should not be larger than the present turnover; 3. The SHG / cooperative / FPO should have sufficient internal resources to meet 10% of the project cost and margin money for working capital. |

| Benefits | Technological and infrastructure upgradation for Food Processing Units.

Grant @35% with credit linkage for capital investment with maximum limit as prescribed; |

4. Seed Capital

| Meaning | Seed capital is for startups who want to build business in this category. Government shall sponsor the idea of the entrepreneur based on a Detailed Project Report. |

| Eligibility for Seed Capital grant under PM FME scheme | For Seed Capital, only SHG members who are presently engaged in food processing are eligible. The SHG member must further utilize this amount for working capital as well as purchase of small tools and give a

commitment in this regard to the SHG and SHG federation. |

| Benefits | Seed Capital @ Rs. 40,000/- per member of SHG engaged in food processing for working capital

and purchase of small tools. |

5. Branding and Marketing Support

| Meaning | Providing Branding and Marketing support to promote the product and increase sales. It also includes standardisation of product quality, packaging, etc. |

| Eligibility criteria | Both Individual or cooperative organisations are eligible to apply for this scheme.

They must produce a DPR (Detailed Project Report) to get selected for support. |

| Benefits | 1. Support up to Rs.5 lakh would be available from State Nodal Agency for preparing DPR for proposals for branding & marketing.

2. Support for branding and marketing up to 50% of the total expenditure with maximum limit as prescribed |

6. Capacity Building & Research

| Meaning | It ensures the entire value chain stays updated and meet with latest efficiency standards. All individuals & institutions members receiving grant would undergo training for upgradation of their skills |

| Eligibility | Individual or group MSMEs in Food Processing business are eligible to apply.

Those enterprises who are seeking benefits under any other government schemes are also eligible to apply. |

| Benefits | Training by National Institute for Food Technology Entrepreneurship and Management,

Indian Institute of Food Processing Technology, or any private institutes selected by government. Essential focus on enterprise operations, book keeping, registration, FSSAI standards, Udyog Aadhar, GST Registration, general hygiene, packaging, marketing etc. Specific training designed on the model of ODOP. |

List of Important documents required for PM FME scheme

- Aadhaar Copy & Photo of all promoters/guarantors

- Address Proof: Utility bill, which is not more than two months old of any service provider, (Electricity, telephone,post-paid mobile phone, piped gas, water bill)/ Property or Municipal tax paid receipt /Ration Card (Individual)

- PAN Card of concern/all promoters

- Photocopy of Bank Statement/ Bank Passbook for the last 6 months.

- Machinery quotation with GST

Process to apply for PM FME scheme

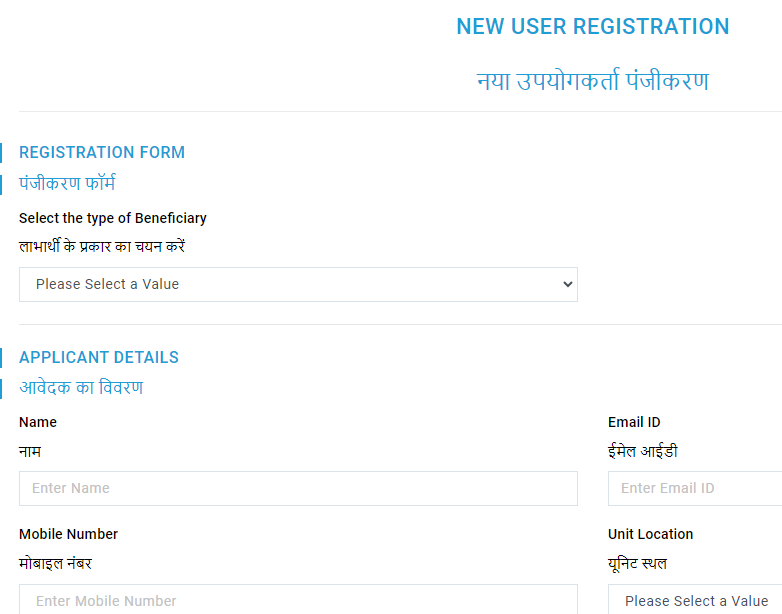

- Visit official website of PM FME i.e pmfme.mofpi.gov.in

- Put your Cursor on Log in Tab and then select Applicant registration (New).

- Fill the form by selecting the type of beneficiary, Name, Address Mobile number etc and then click on Register. You will receive a password generation link on your mobile number.

- Log in with your registration id and password.

- Fill your DPR (Detailed Project Report). DPR includes following 6 steps.

- Applicant Details– Enter your name, Parent’s/Spouse name, /address etc.

- Proposed Business Details– Enter details of your Enterprise like its Name, Address, type of property, etc. Select if you want to take loan for working capital. Enter your Bank Details.

- Propose Financial Details– Now enter financial information of business like Type of building, area, Machinery, Pre-operative cost, Product sales etc. Only Tin shed/Asbestos shed/ Minor civil construction/Flooring/ storage type of buildings are eligible.

- Enter your working capital estimate, Miscellaneous expenditures, Building rent, Period of loan repayment, Depreciation, Balance Sheet. Net profit ratio, Break even point analysis is also important.

- Lending Bank– Enter information about the bank you will borrow loan from. The bank must be in the same district.

- Upload Documents– Applicants shall now upload his documents like Adhaar card copy of all guarantors, Address proof, Individual Ration card etc.

- Declaration and Submit– Finally click on the declaration box after reading all the conditions. Click on Submit and your PM FME application is now submit.

Important Instructions under PM FME scheme

- Full Concrete structures are not eligible to apply under PM FME Scheme. Technical civil works of the structure shall not exceed 30% of the project’s cost.

- Only following types of building are eligible under PM FME Scheme. Tin Shed, Tin shed, Asbestos shed, Minor civil construction, Flooring, Storage.

- The Bank must be in the district of the applicant.

- The applicant organization’s contribution should be minimum of 10% of the project cost with balance required funds (including Grants-in-Aid) being loan from Bank.

click here to go to official website of PM FME loan, subsidy online application

- PMFME loan Govt Scheme Apply

- Highlights

- About PM FME

- Elements of PM FME scheme

- General Eligibility Criteria for PM FME scheme

- 1. One-District-One-Product (ODOP)

- 2. Support to processing units

- 3. Upgradation of Food Processing Units

- 4. Seed Capital

- 5. Branding and Marketing Support

- 6. Capacity Building & Research

- List of Important documents required for PM FME scheme

- Process to apply for PM FME scheme

- Important Instructions under PM FME scheme

Very good step but banks are not following Govt. Circular very sad hopeful action will take against it